A Credit Score Is Intended To Measure…

A credit report goes back along way in history and was meant to be a good thing. To understand your credit report, and then some time later your credit score, it’s important for us to know why and when they were started. Early credit reports were started by small groups of merchant owners sharing information about the people they have done business with.

The earliest recording of one of these groups is from 1776 and the long winded, detailed name of the group was Society of Guardians for the Protection of Trade against Swindlers and Sharpers. There were earlier forms of credit reports that date back all the way to Babylonian times, but these small groups is what has led to the 3 major credit reporting agencies we have come to know in our day.

In different areas you would have these small merchant groups passing around information about you that contained some credit worthiness material, but that also contained a lot of gossip. Soon the gossip overran most, if not all, of the credit worthiness. People would interview neighbors, friends and associates about you, and would scan the newspapers for anything they could clip and add to your report including arrests, marriages and deaths. When someone new came into the area the so called “Welcome Wagon” were sometimes people that worked for these credit agencies who were sent to gather as much information as they could about you.

What started out as a good intention to support business owners by equipping them with more information to determine credit worthiness, basically turned into a combination of a mild witch hunt and a soap opera. Credit reports were filled with a lot of opinions, he said – she said stuff and collected information, that as you can imagine, did not bring a good light on the person. People have always tended to pass along bad and hurtful information a lot better and faster than good wholesome uplifting information. What’s even worse is that no one could see the information on their report. So they couldn’t say if something was true or a lie.

This kind of reporting went on for some time and started to change in the 1820’s, mainly for commercial loans, people getting loans for their businesses. With new bankruptcy laws in place, businesses were taking more of a risk loaning out money. So credit reports started trying to be more standardized for business owners. Still these reports contained prejudice remarks, opinions, rumors, habits of these people and so much other non-important information.

Businesses were still finding it hard to search through all this material, with most of it not related to credit worthiness of the business. Finally the cry was heard and in 1864 a better system was developed for commercial applications. An alphanumerical system was created.

But it wasn’t until 1912 that a system for the consumer was really put together. Some of the aspects from the commercial credit reporting methods was combined with original ideas to make a better way of sharing, collecting and coding the public transactions. Over the years they made improvements to this system and then in 1956 a huge addition was added. A mathematician named Earl Isaac and an engineer named Bill Fair created the first credit scoring system. It was refined in 1989 to the FICO (Fair Isaac Corporation) score we all know today.

In the 1960’s a lot of these small independent reporting agencies started joining together forming larger networks that covered the nation. A person’s valid information for credit worthiness was being entered and still a person’s social, sexual and political lives along with opinions continued on. It has taken awhile for our credit report to get to this point while we, as a nation, are soaring in leaps and bounds in technology, and still we can’t shake our desire to add non essential information.

At the thresh hold of the computer age, these reports would soon become digitized files. Privacy issues came up with these reports having people’s personal lives forever documented. Civil rights activists along with concerns of the people were finally heard after writing to the newspapers, magazines and speaking on radio programs against what was being reported. That is why in 1970 the Fair Credit Reporting Act came into effect. This required these bureaus to expunge opinionated comments, arrests, marriages and other non-important data related to credit worthiness.

The FCRA also required that relative negative information be removed in a specified time period and encouraged positive information to be recorded. Consumers, for the first time, could see what is on their credit reports and dispute it. In 1996 an amendment was added to the FCRA and basically gave the consumer more control over their information and the ability to pursue legal action against companies misusing their information, along with a time frame in which a company has to respond to a dispute.

Not all of what came out from the earlier years was bad, even though it had major problems. A lot of people were able to get loans and provisions they needed for business and family. Not having any kind of credit system, like some places dealt with, you had instead the buddy system. It was basically who your friends were and your family relationships. Times could really be hard for you and your family if you wasn’t in the click.

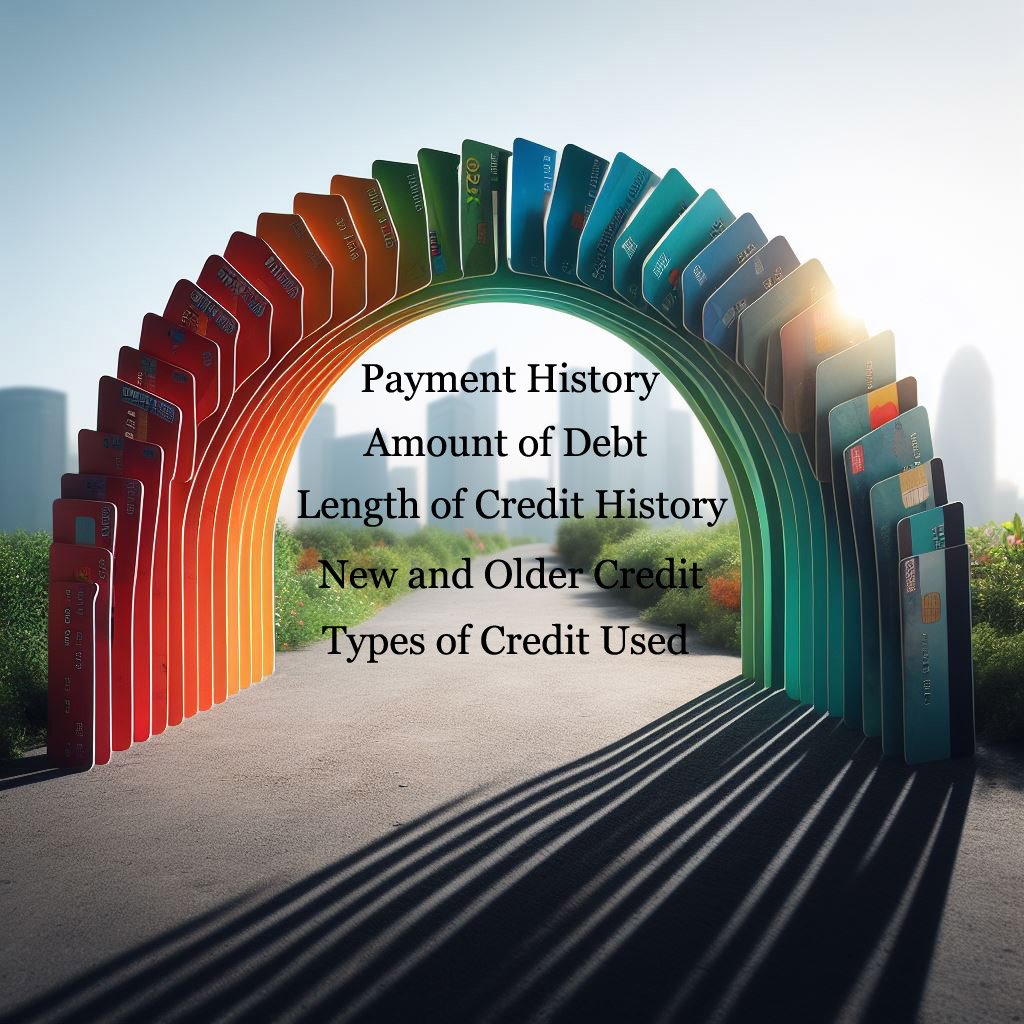

So what it comes down to is that a credit score is intended to measure the combination of all the relative information in your credit report. Basically these things:

• Payment history

• Amount of debt you owe

• Length of credit history

• New and older credit

• Types of credit used

Thanks to our modern reports, our information contained within our credit reports are valid and we can attest to that or have it removed. Businesses use to have to really research through your report and determine your credit worthiness by weighing in on your activity. Difficulties would be in what activity do I weigh more heavily than another. Now with a trusted algorithm to display credit scores, companies can quickly base their decisions on it to determine whether they will give you that loan or not.

If you are interested in learning more about credit I have a great article Credit Secrets that I believe you will enjoy.